Description

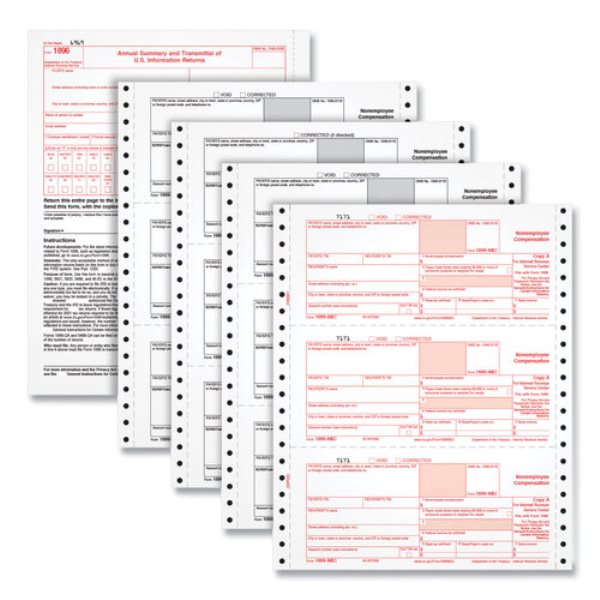

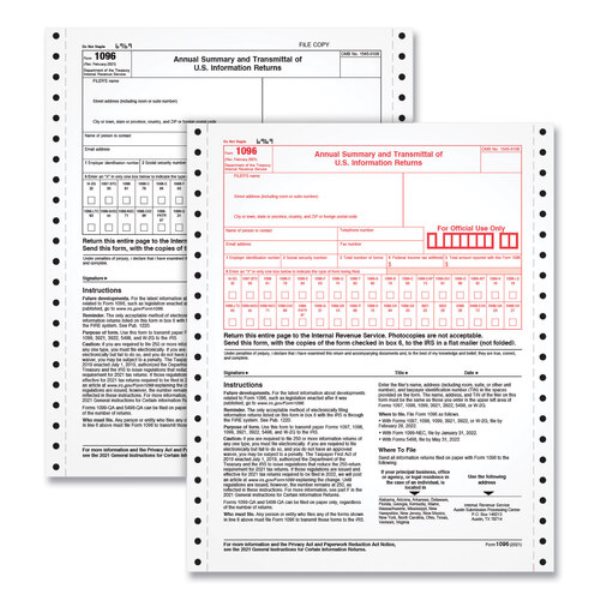

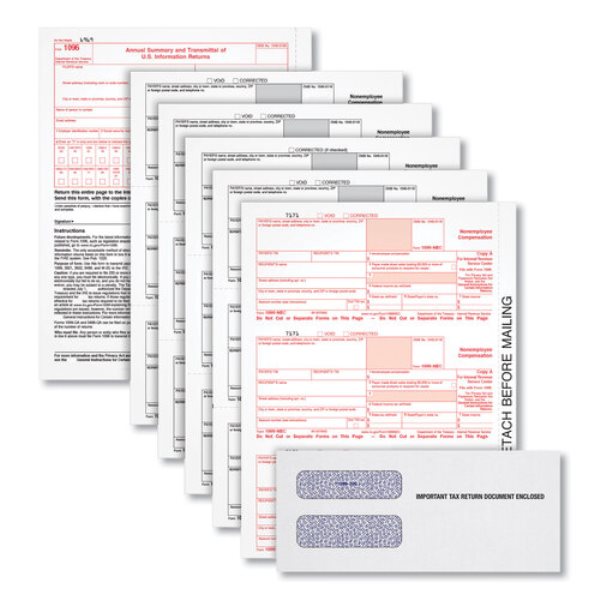

TOPS™ 1096 Summary Forms transmit the totals for select information returns to the IRS. You'll use the 1096 to summarize your 1097, 1098, 1099, 3921, 3922, 5498 and W-2G forms. You'll need a separate 1096 for each type of form you file. Our acid-free paper and heat-resistant inks help you produce smudge-free, archival-safe tax forms. Forms have the scannable red ink required by the IRS for paper filing and meet IRS specifications. QuickBooks and accounting software compatible. <ul><li>Includes 1096 summary and transmittal forms.</li><li>Use Form 1096 to submit the totals from information returns 1097, 1098, 1099, 3921, 3922, 5498 and W-2G to the IRS; each form needs its own 1096 cover.</li><li>Acid-free paper and heat-resistant inks help you produce legible, smudge-free, archival-safe records.</li><li>Scannable red ink required by the IRS for paper filing.</li><li>Meets IRS specifications; accounting software and QuickBooks compatible.</li><li>The 1096 Summary and Transmittal form is due to the IRS when Copy A forms for information returns are due; see IRS instructions for complete details.</li></ul>

Be the first to review “TOPS™ 1096 Tax Form” Cancel reply

You must be logged in to post a review.

Reviews

There are no reviews yet.